Risk Analysis

OakTree Investment Advisors incorporates a four-part analytical approach in our buying and selling process. Successfully integrating fundamental, technical, risk, and macro analyses provides an optimal comprehensive strategy to meet or exceed investment objectives.

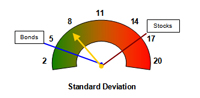

"Standard deviation" is a measurement of volatility, and volatility is a measurement of risk; the greater the volatility, the greater the risk. Historically, the standard deviation of bonds is approximately 4% and of stocks approximately 15%.

We track the standard deviation of our client’s accounts on a monthly basis and report it to them quarterly on a simple, easy-to-read

RISK METER:

"Beta" is also a risk-measuring tool that shows a comparison of how the portfolio’s risk compares to that of a benchmark. Many brokers only look at beta to evaluate risk. But, since beta never tells investors how much actual risk they are exposed to, it is an inappropriate device for determining risk in a client’s portfolio. Although we will look at beta for reference in combination with other risk factors, we avoid using it as an exclusive risk-measuring tool.